Discover how an LMI waiver can help you buy sooner, reduce costs, and avoid lenders mortgage insurance entirely—even with a smaller deposit.

At Ausfirst Lending Group, we simplify the process by providing clear advice, access to low deposit loan options, and help with navigating government grants and incentives—so you can buy with confidence and avoid common first-time mistakes.

Buying a home with less than a 20% deposit often means paying costly Lenders Mortgage Insurance (LMI) – a fee that protects the lender, not the borrower. But what if you could skip that expense entirely? With an LMI waived loan, eligible professionals could avoid this upfront cost and potentially enter the property market sooner.

At Ausfirst Lending Group, we assist first home buyers and professionals in navigating lender policies to secure loans LMI waivers. Whether you're applying for an LMI exemption in Queensland or seeking mortgage insurance waivers through specialised lenders, we guide you every step.

Our strategic approach ensures significant savings, with our clients often saving thousands by choosing loans that don’t require Lenders Mortgage Insurance (LMI).

For example, a recent client—an early-career doctor purchasing her first home—secured a 90% loan-to-value ratio (LVR) loan without paying LMI. Typically, LMI on a $900,000 property with a 10% deposit could cost upwards of $20,000. However, due to her medical profession status, we arranged an LMI waiver, enabling her to put her savings directly into her new home’s fit-out rather than into unnecessary insurance premiums.

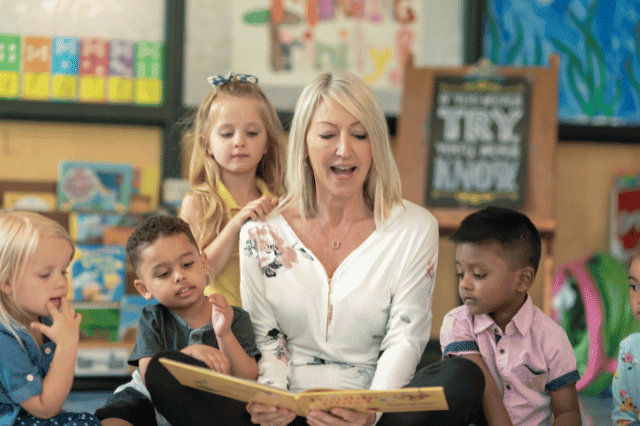

Similarly, a schoolteacher couple we assisted were approved for an 85% LVR loan without LMI on a $700,000 home. Normally, they would’ve been charged around $9,000 in LMI. Thanks to lender policies that acknowledge the income stability and low default risk of educators, we successfully negotiated an exemption, fast-tracking their homeownership journey and saving them significant upfront costs.

LMI is generally mandatory if your deposit is less than 20% of the property value. While it protects the lender from potential loan defaults, it can cost borrowers tens of thousands of dollars.

With an LMI exemption, eligible professionals—including doctors, engineers, and accountants—could borrow up to 90% of the property's value with no lenders mortgage insurance required. This LMI waiver scheme helps reduce upfront costs, making it easier to enter the market sooner.

This exemption is granted because lenders often consider these professions as lower risk due to their income stability and employment security.

Here are some potential financial benefits that LMI waived loans could provide for eligible professionals:

LMI can add a significant sum to your upfront costs – often over $20,000 for homes around $1 million. If you're an eligible borrower, you could bypass this entirely and enjoy substantial savings.

With an LMI waiver, you may not need to wait until you've saved a 20% deposit to buy a home. This could help fast-track your path to property ownership, especially in competitive markets.

Avoiding LMI may give you more flexibility in how you use your funds. You might be able to afford a better location, renovate your property, or keep more cash for moving costs or financial buffers. Read More

Below is a breakdown of the general conditions you'll need to meet to be eligible for an LMI waived loan. These criteria vary slightly by lender and profession:

There are different types of loans with LMI waivers. Depending on your eligibility and financial position, one of these options could suit your goals:

Even if you don't qualify for a professional LMI waiver, you might be eligible for a government-backed initiative. For example, the First Home Guarantee (FHBG) allows first-time buyers to purchase with a 5% deposit and no LMI, with the government guaranteeing up to 15% of the loan.

Another government scheme is the Regional First Home Buyer Guarantee (RFHBG), which offers similar benefits to first home buyers purchasing in eligible regional areas.

These programs have income, property value, and availability limits – a mortgage broker can help determine your eligibility and assist with your application.

If you're struggling to save a full 20% deposit, you're not alone – and you may not need to. By exploring lender-approved LMI waiver programs for eligible professionals, you could reduce upfront costs and direct savings towards other financial priorities, such as home upgrades or reserves.

At Ausfirst Lending, we can help you make the most of these profession-specific benefits by identifying lenders offering LMI waivers and structuring a loan aligned with your long-term goals. Our team will work with you to review your eligibility and provide guidance through the loan application process – so you can focus on moving in instead of paying extra fees.

At Ausfirst Lending Group, you are our top priority. We are dedicated to providing comprehensive assistance from start to finish, not just because we are legally obligated to act in your favour, but because we genuinely want to ensure your success.

We focus on your objectives and requirements, and combine deep industry knowledge with a strong commitment to finding loan options that truly align with your financial needs. We simplify the entire loan application process by assessing your borrowing capacity, organising documentation, and negotiating terms on your behalf, all while securing the most favourable outcomes for you.

One of the key benefits of working with Ausfirst Lending is our access to a diverse range of lenders. Instead of presenting just one option, we assess a broad array of options according to your financial needs. This allows us to tailor solutions that match your specific goals and circumstances, ensuring you get the best possible outcome. Read Less

Lenders Mortgage Insurance (LMI) waivers are a highly sought-after benefit, but not everyone qualifies. They are generally reserved for specific professionals whose careers offer income stability and lower lending risks. Eligibility often depends on your profession, income threshold, and membership with recognised industry bodies. At Ausfirst Lending Group, we navigate these lender-specific criteria to ensure you access all available benefits. Eligible professions typically include:

Doctors, dentists, surgeons, anaesthetists, nurses, and allied health workers (such as physiotherapists, chiropractors, optometrists, and psychologists) frequently qualify for LMI exemptions. Registration with bodies like the Australian Health Practitioner Regulation Agency (AHPRA) is often required. Our tailored home loan services for healthcare professionals ensure your complex income—whether through private practice or shift work—is recognised appropriately.

Lawyers, solicitors, barristers, and conveyancers with memberships in recognised law societies are commonly eligible for LMI waivers. Additionally, some lenders extend these benefits to police officers, firefighters, and defence personnel, acknowledging the stability and service-oriented nature of these professions.

Accountants, auditors, and financial planners holding Certified Practising Accountant (CPA) or Chartered Accountant (CA) memberships are considered low-risk borrowers and often qualify for LMI-free loans. Our lending solutions are crafted to suit the layered income streams and deductions typical within the finance sector.

Engineers across civil, mechanical, electrical, and structural disciplines—particularly those registered with Engineers Australia—are often eligible for LMI exemptions. Certain lenders may also extend this to IT specialists and project managers, depending on income stability and role specificity.

School teachers, university lecturers, early childhood educators, and even self-employed tutors may qualify for LMI waivers, provided they meet the lender’s criteria for employment stability and income documentation. At Ausfirst Lending, we’re experienced in advocating for teachers and education staff, ensuring their critical role in the community is recognised within their loan application.

Some lenders also consider LMI exemptions for high-earning creatives, professional athletes, and select business owners, based on demonstrated income stability and membership in recognised industry bodies.

At Ausfirst Lending Group, we specialise in delivering tailored home loan strategies that align with your career path, financial patterns, and long-term goals. Whether you’re a healthcare professional with varying rosters, an educator with steady employment, or a legal professional with scalable income, we know which lenders offer the most favourable LMI-free options for your profession.

Optimised for complex income scenarios, including private practice earnings, hospital shifts, and ABNs.

See Doctor Loan Benefits

Flexible loan terms aligned with rotating shifts and frontline service benefits.

Discover Nurse Lending Options

Structured loan solutions designed for career progression within the legal sector.

Explore Legal LMI Waivers

Reliable mortgage options that consider stable service incomes and allowances.

See Police Lending Solutions

Loan structures designed to manage layered income sources and business deductions.

Accountant Loan Packages

Lending options for engineers with contract-based or salaried employment structures.

Engineer LMI Waiver Solutions

Specialised lending for educators with secure incomes and eligibility for LMI waivers.

Explore Teacher LMI WaiversWe start by understanding your profession, career stage, and homeownership goals through an initial consultation (phone, Zoom, or in person).

We collect essential documents—such as payslips, industry registrations, and employment contracts—to confirm your eligibility for LMI waivers.

We evaluate your profession-specific benefits and craft a lending plan that maximises your LMI waiver opportunities and aligns with your financial goals.

We handle the entire application process, partnering with lenders who recognise the professional value you bring, ensuring you access premium terms without LMI.

From loan approval to settlement, we coordinate all steps to deliver a smooth, stress-free experience while you focus on your career.

Our relationship doesn't end at settlement—we provide ongoing support to review your loan, ensuring it remains competitive as your circumstances evolve.

LMI waivers are often available to medical professionals (doctors, nurses, dentists), legal practitioners (lawyers, solicitors), accountants, engineers, and sometimes teachers. Certain IT professionals, architects, and high-income creatives may also qualify depending on lender criteria.

Major banks like ANZ, Westpac, NAB, and Commonwealth Bank offer LMI waiver programs for eligible professionals. Non-bank lenders also provide LMI exemptions based on specific criteria. Consulting a mortgage broker can help you compare which banks currently offer these waivers and align them with your profession.

First home buyers may avoid LMI with a 5% deposit through government initiatives like the First Home Guarantee (FHBG), where the government acts as a guarantor for up to 15% of the loan. This program has strict eligibility conditions regarding income and property price limits.

LMI is not automatically waived for all first home buyers. However, through the First Home Guarantee Scheme or if you are part of an eligible profession, you might avoid paying LMI even with a smaller deposit. Lender-specific criteria apply.

Professionals working in Queensland, such as doctors, lawyers, accountants, and engineers, may be exempt from paying LMI if they meet lender requirements. Additionally, Queensland first home buyers could benefit from government schemes designed to eliminate LMI for low-deposit purchases.

A 90% no LMI home loan allows eligible professionals to borrow up to 90% of a property's value without paying LMI. This is typically offered to borrowers considered low-risk by lenders, such as those with stable, high-income professions and memberships with industry bodies like CPA or AMA.

Not everyone can avoid paying LMI. Borrowers can bypass LMI by having a 20% deposit, qualifying for an LMI waiver through their profession, or utilising a government-backed guarantee program like the First Home Guarantee. Each option has specific eligibility requirements.

LMI is generally compulsory for borrowers with deposits below 20%. However, exemptions apply to certain professionals deemed low risk, or through government-backed schemes designed to support first home buyers. Eligibility depends on your deposit size, profession, and the lender's policy.

Common professions that may avoid paying LMI in Australia include doctors, dentists, nurses, lawyers, accountants, engineers, and teachers. IT specialists and certain self-employed professionals may also qualify, depending on their income and lender-specific guidelines.

At Ausfirst Lending, we believe securing the right loan should be a personalised journey. When you choose us, you work directly with Richard, our founder, who brings over 30 years of experience helping clients access competitive lending solutions across Queensland.

Unlike larger brokerages where you’re just a number, Richard personally manages your loan process — whether it involves accessing an LMI waiver, refinancing, or structuring an investment loan. His industry knowledge ensures tailored strategies, a smooth experience, and advice aligned with your long-term financial goals.

We’re not just mortgage brokers; we’re your lending partners. With transparency, accessibility, and genuine care at the core of what we do, you’ll receive the kind of guidance that comes from decades of real-world expertise.

Simply put, you’ll be looked after by someone who treats your financial success as his own.

Secure Your No-LMI Mortgage Today →Whether you're exploring LMI waived loans, looking to refinance, or need strategic guidance for trust or SMSF lending, we’re here to guide you with a personal approach. As your dedicated Mortgage Broker on the Sunshine Coast, we deliver solutions tailored to your financial goals.

Location: Suite 3/74 Bulcock St, Caloundra QLD 4551

📍 View on Google Maps

Whether you’re upgrading your home, developing new property, or expanding your business premises, our tailored loan solutions are designed to align with your financial goals while reducing upfront costs. For eligible borrowers, we explore LMI waiver opportunities that help minimise out-of-pocket expenses—freeing up capital for your renovation projects or commercial ventures.

Looking to purchase your first home or upgrade to your next property? Our homeownership loans are crafted to maximise your borrowing capacity while reducing upfront costs through LMI waivers wherever possible. Whether you’re a first-time buyer or refinancing, we offer structured solutions that make the path to homeownership more affordable and efficient.

Discover first home loan options with potential LMI waivers that make stepping into property ownership more affordable.

Check First Home Eligibility

Leverage your existing equity and explore second home loans with streamlined approval processes.

Upgrade with Confidence

Unlock your property’s equity for renovations, investments, or debt consolidation—potentially without paying LMI.

Use Your Equity

Refinance your current home loan for better rates or to take advantage of LMI-exempt lending options.

Refinance and SaveFor those aiming to build a property portfolio, our investment loan solutions offer strategic lending structures that may include LMI exemptions, enabling you to allocate more of your funds towards growth. From SMSF lending to rentvesting strategies, we align your loan with your long-term investment goals while optimising your cash flow.

Access investment loan structures designed for growth, with options that may bypass LMI costs for eligible professionals.

Explore Investment Options

Invest through your self-managed super fund with tailored SMSF loan solutions that optimise lending outcomes.

Utilise Your Super Fund

Secure financing within a trust structure to manage wealth and minimise tax impacts—some lenders may waive LMI for trusts.

Finance with a TrustOur specialised loan offerings—such as low deposit loans, 100% offset accounts, and family guarantee options—are designed to address unique scenarios. Many of these solutions come with LMI waived benefits, helping you secure financing with reduced upfront costs while retaining flexibility in your loan terms.

Ideal for professionals with solid income but limited savings, offering pathways to avoid LMI despite lower deposits.

Discover Low-Deposit Solutions

Reduce your interest with an offset account linked to your mortgage, while maximising lending efficiency.

Minimise Interest Costs

Use a family member’s home equity to secure your loan, potentially bypassing LMI even with smaller deposits.

Learn About Family GuaranteesEnhancing or upgrading your property? We provide financing options for renovations and eco-friendly improvements that consider your existing equity, potentially eliminating the need for LMI. Whether it’s a simple upgrade or a large-scale renovation, we ensure your loan structure supports your property goals while maximising cost-efficiency.

Transform your property with renovation loans tailored to your project's scale. For eligible applicants, we structure these loans to leverage existing equity, helping you avoid unnecessary LMI expenses.

Upgrade Your Home

Finance sustainable home upgrades with loan options that reward eco-friendly improvements. Depending on your equity and profile, LMI waivers can be applied to reduce upfront costs.

Go Green with FinancingAusfirst Lending Group is proud to be recognised as a finalist in the 2024 Sunshine Coast Business Awards under the Professional Services category, showcasing our commitment to excellence and dedication to serving the community with integrity and expertise.

We don’t just find you a loan that fits; we aim to get one that exceeds your expectations in terms of rates, options, and service.

We work with over 40 lenders, including big banks and non-bank lenders, giving you unparalleled mortgage choice—you have plenty of options to choose the most suitable home loan for you.

Our team is dedicated to guiding you throughout your homeownership journey, whether it’s securing your first home or an additional investment property. We provide ongoing support, including a 6-month review process to keep your loan competitive.

Every mortgage broker on our team has over 10 years of industry experience, ensuring expert advice every step of the way.

We tailor home loan solutions that prioritise your best interests, not the bank’s.

Our entire process is transparent and easy to understand, making the entire journey hassle-free.