The Real Reason Tradies Are Saying “Yes” to More Jobs in 2025

You’re quoting jobs back-to-back. Clients want you. But your bank account? It’s stuck waiting for slow payments, while new projects

You’re quoting jobs back-to-back. Clients want you. But your bank account? It’s stuck waiting for slow payments, while new projects

Running behind on a job doesn’t just mean a few grumpy clients or shifting your weekend plans. In the construction

Picture this: You’ve just landed a game-changing project. It could bring in serious revenue and open the door to more

Ever lost a job simply because you didn’t have the cash to take it on? You’re not alone. Across Australia,

Ever had to delay a project because of late payments? Or dip into your own savings just to cover wages

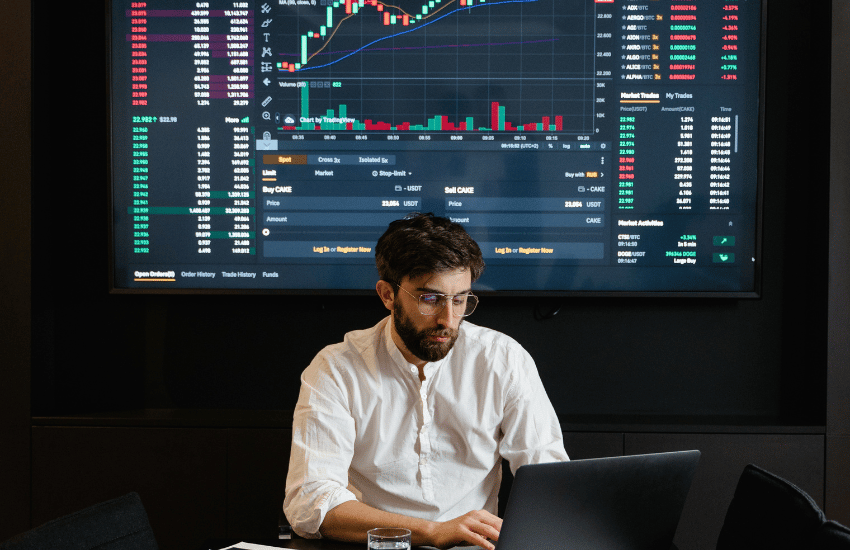

For many Australians, achieving 10%+ returns is more than just a number. It represents financial independence, early retirement, or simply

You’ve stepped into the classroom, started shaping young minds, and built a career around making a difference. Now, as you

Buying your first home as a teacher in Australia can feel out of reach, especially when you’re managing lesson planning,

Home ownership might feel like a distant dream when you’re a part-time or casual teacher juggling contracts, side gigs, and

The latest RBA interest rate cut has brought Australia’s cash rate down to 3.85%. But while headlines shout “relief” and

Managing significant wealth presents a distinct set of challenges for high-net-worth Australians. As your portfolio grows, so does the complexity

Thinking about refinancing your home loan but unsure if it’s the right time? You’re not alone. Whether you’re aiming to

Owning a home might seem like a distant goal for many single mums in Australia, especially when juggling so many

Timing is everything in real estate, but things don’t always fall into place as planned. You might be ready to

When you hear the term negative gearing, what comes to mind? Tax perks for investors, sky-high house prices, or a

You’ve spent decades building equity in your home. But now, as your financial priorities shift towards retirement, care needs or

You’ve been watching the market. Maybe you’ve run the numbers on how long it’ll take to save a deposit. Maybe

Selling property in Australia often comes with an unexpected cost, Capital Gains Tax (CGT), which can take many owners by

If you’re wondering whether you can move into your rental property to help minimise capital gains tax, you’re not alone.

When you hear about “releasing equity,” it can sound a bit complex at first. But at its core, it’s about

There’s nothing more exciting than transforming your home into a space that better suits your lifestyle. Whether it’s a sleek

When it comes to structuring your home loan in Australia, features like offset accounts and redraw facilities can quietly make

Thinking about buying your first property or another one on the Sunshine Coast this year? You’re not alone. With so

The RBA interest rate cut has lowered the cash rate to 4.1%, marking the first interest rate reduction since 2020,

The RBA has cut the official cash rate by 0.25%, lowering it from 4.35% to 4.1%. This interest rate cut

Today (19 February 2025), the Reserve Bank of Australia (RBA) announced a 0.25% cut to the official cash rate, bringing

Managing a business as a sole trader in Australia comes with a lot of responsibilities. One of the main challenges

If you’re a sole trader in Australia, knowing what tax deductions you can and can’t claim can help you reduce

For many self-employed plumbers, the dream of homeownership can feel out of reach due to the hurdles of getting a

Being self-employed offers freedom and flexibility, but it also comes with its own set of challenges, especially in retirement planning.

Managing taxes can be stressful for small business owners. With so much to handle, such as tracking expenses and meeting

Business growth often requires capital, and for many Australian entrepreneurs, a business loan can be the perfect solution. Ausfirst Lending

Applying for home loans for tradies as a self-employed carpenter comes with unique challenges, especially when your income isn’t as

Being a sole trader in Australia gives you freedom, but it also means handling your own finances. One of the

Being a sole trader lets you work on your own terms, but it also means managing all financial responsibilities yourself.

Budgeting is an important part of running a business. It helps you take control of your finances, manage expenses, and

Managing cash flow is essential for running a successful business, particularly in Australia, where unique market conditions and economic factors

Running a small business in Australia is exciting, but it also comes with financial challenges. Whether you’re just starting out

Moving to a new home is an exciting chapter, full of opportunities for fresh starts and new beginnings. Let’s face

With the prediction on interest rates in Australia indicating prolonged elevated levels, many homeowners are grappling with the financial strain

Relocating, pursuing a lifestyle change, or re-evaluating your budget? Understanding the cost of living in Australia is essential for making

The Reserve Bank of Australia (RBA) recently announced its monetary policy decision to keep the cash rate target steady at

Have you found your dream home but haven’t sold your current one yet? Or maybe you’re ready to move but

Fixed rate mortgages guarantee a consistent interest rate over a set period, making them a popular choice for Australians who

When growing your Self-Managed Super Fund (SMSF), few opportunities offer as much potential as SMSF NDIS property investment. National Disability

Investing in a National Disability Insurance Scheme () property is more than a mere financial decision; it’s about creating a

Investing in property using a Self-Managed Superannuation Fund (SMSF) is a popular strategy for building retirement wealth. It offers investors

Managing cash flow in a Self-Managed Superannuation Fund (SMSF) is crucial, especially when the fund has taken on a property

Property investment is one of the most popular investment strategies within Self-Managed Superannuation Funds (SMSFs), which can provide both capital

Often chosen for the control they offer, Self-Managed Superannuation Funds (SMSFs) empower Australians to directly manage their retirement savings by

Refinancing an SMSF loan offers a strategic way to enhance financial outcomes, providing opportunities to optimise cash flow and secure

A Self-Managed Superannuation Fund (SMSF) is a popular choice for Australians who wish to control their retirement savings directly. One

Establishing a Self-Managed Super Fund (SMSF) to invest in property can be a sound strategy for building long-term wealth, but

To understand the role of a custodian trustee, it’s important to have a basic understanding of a Self-Managed Super Fund

SMSF loans, or Self-Managed Super Fund loans, are specialized borrowing arrangements in Australia that allow individuals to use their SMSF

Self Managed Super Loans provide a unique opportunity to use retirement savings to invest in property. They offer greater control

Exploring commercial property can be an attractive option for those looking to diversify their portfolio and generate significant returns. However,

Owning a rental property in Australia offers the potential for significant financial returns, but understanding the tax implications is crucial

The Australian property market has long been a favourite among investors, both local and international, for its stability, potential for

At its core, negative gearing occurs when the costs of owning an investment property exceed the income generated from that

A Self-Managed Super Fund (SMSF) provides a unique way for you to manage and grow your retirement investments, including the

Entering the property market can be both exciting and daunting for beginners. One of the first major decisions you’ll face

Capital Gains Tax (CGT) is an unavoidable consideration for those who own and sell property in Australia. While it can

Trust loans can be a powerful tool for those looking to invest in property, providing flexibility, tax benefits, and asset

Property investment is a significant financial undertaking, and choosing the right structure to hold your assets can have profound implications

Investing in property is a significant financial commitment, and choosing the right type of loan is crucial to maximising your

In Australia, the property market has long been a favoured investment avenue, offering the potential for stable returns and capital

In recent years, an increasing number of first-time investors have been drawn to the property market in Australia. Whether it’s

You’re quoting jobs back-to-back. Clients want you. But your bank account? It’s stuck waiting for slow payments, while new projects

Running behind on a job doesn’t just mean a few grumpy clients or shifting your weekend plans. In the construction

Picture this: You’ve just landed a game-changing project. It could bring in serious revenue and open the door to more

Memberships

Business Information

Ausfirst Lending Group Australian Credit Licence Number: 387366 | ABN: 68 845 798 048

Finsurance Pty Ltd t/a Ausfirst Lending Group credit representative number 414391. Finsurance Pty Ltd is a credit representative of Oshawa Pty Ltd Australian Credit Licence number 387366. AFCA 42404

Your full financial situation and requirements need to be considered prior to any offer and acceptance of a loan product.

Copyright © 2024 Ausfirst Lending Group | All Rights Reserved | Design & SEO by Marketing Agency Pro